Wondering if setting up a mineral water plant is still a good investment in 2025? Absolutely so. The demand for safe packaged drinking water in India has experienced a quantum leap, propelled by health consciousness and an inadequate water supply from the government. According to industry sources, Indian bottled water market values to about $8.28 billion in 2025, growing at ~10.5% annually until it hits ~$13.65 billion by 2030. Rapid urbanization, rising disposable incomes, and consciousness toward good health continue fueling the market. Well, in that case, a well-run water bottle business can garner double-digit profit margins: Industry benchmarks suggest margins of 10–15% on average (and higher than that for premium brands). To put it simply, the basics are good – large volume sales and high demand make the Water Bottle Business a lucrative growing opportunity in 2025.

Figure: According to Mordor Intelligence, India's bottled water market is moving northward and is estimated to be of $8.28 B in 2025 and $13.65 B by 2030.

Major bottled water brands have monopolized big time in this space, but new entrants and niche brands do keep coming in. The leading companies in India's mineral water plant sector are Bisleri (Parle Agro), Tata Consumer Products (Himalayan), The Coca-Cola Company (Kinley), PepsiCo (Aquafina), and DS Group. The market is still highly consolidated with almost 75 percent of the sales accounted for by the top five players, but there is some room for new startups, especially in the areas of sustainable packaging and value-added products. In fact, innovation is being channeled toward taste/purity, flavored or functional water options, and eco-friendly packaging. Consumers have been upgrading to these premium and fortified water brands. For instance, glass-bottled water elements that are alkaline or "Himalayan source" have seen niche patronage.

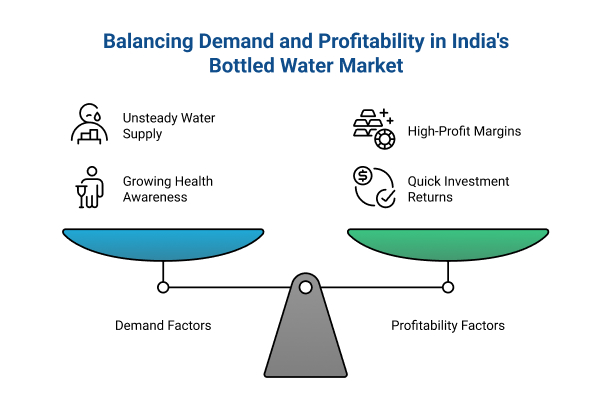

Unsteady municipal supply and growing health awareness have been the rising factors behind the bottled water demand in India. Studies show many Indian cities still lack reliable clean tap water and thus households and businesses increasingly depend on packaged water as a safe necessity.

Even government-sponsored schemes like the Jal Jeevan Mission cannot completely address contamination and scarcity at the last mile. Such a structural gap supports solid demand growth. According to industry estimates, India’s packaged water CAGR in double-digit: one report claims a 12–15% annual growth over the next five years, while others predict a growth rate in the mid-to-high single-digit range (7–10% CAGR) for 2025–2030.

More demand means more profit. Bottled water generally enjoys a higher margin (20–30% in many markets) because raw water is cheap, and high-volume sales add up. A small production cost marked by overheads notwithstanding, a plant that is well run can break even within just a few years. Those in mature markets return their investment in two to four years. Beyond pure numbers, India’s market features some fledgling premium segments: flavored, fortified, and premium-branded waters that can command even higher margins. In an environment of rising inflation and input costs, bottled water is a recession-proof product: consumers would pay a premium for perceived purity and convenience.

You can read more about regional market trends in our articleRising Demand for Mineral Water Plant in Himachal Pradesh

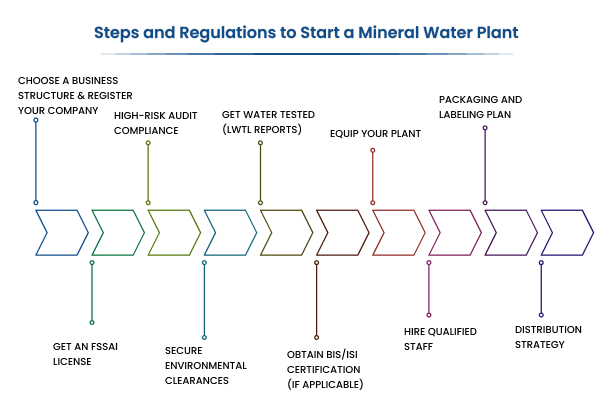

The process of setting up a mineral water plant in India is essentially straightforward, provided you have your driveway clear with the following checklist:

By ticking off these steps with uncompromising quality, regulatory procedures can be adhered to, establishing consumer trust. While this initially requires investment and some paperwork, the increasing demand will help you withstand it all in no time once you are into production.

To see how tourism impacts demand, read our blog'Packaged Drinking Water Plant Units: Why Tourism Hotspots Like Varanasi and Agra Need It More'.

The water industry is looking to change. On one side, consumers' expectations have certainly risen from water for drinking, and they want the water to have health benefits with an eco-friendly appeal. From another point of view, functional water (vitamin-infused, alkaline, electrolyte-enhanced) is fast growing in demand among fitness-community and urban buyers, with flavored waters increasingly becoming popular. Another category which is growing is premium packaged water marketed from pristine sources-or at least those marketed with a slightly glacial or slightly spring imagery. E-commerce has also found prominence: selling bottled water through online platforms-even subscriptions-is a new channel for smaller brands.

At the same time, sustainability is deciding the shape of the market. Plastic Waste must adhere to new standards being promulgated in India-from April 2025, any new PET beverage bottle must have at least 30 per cent of its content as recycled plastic. Many companies are switching to PET or alternate packaging, even preemptively. Even the regulators have stepped in one study found an average of 240,000 microplastic particles per liter in some bottled waters, raising the alarm. From the way customers view it, such will win plants in exchange for adopting biodegradable bottles, reusable glass bottles, or bottle-return schemes. Innovations in sustainable packaging solutions are precisely the focus today in the industry.

Sometimes just being presented as an eco-friendly brand can give you that edge over another competitor. After all, any green initiatives should be promoted, such as your mineral water plant using recycled PET bottles, or you support local recycling programs. These angles will hit home with today’s consumers and were once considered very powerful marketing points.

Once you establish your mineral water plant, however, it is marketing that truly sets you apart.

Reinforce quality and safety: display your FSSAI license and your BIS/ISI certification (if you obtained one). Many consumers look for these as trust marks. Assure, in the local language, in a casual way, that your water has been lab-tested and is 100% pure.

Differentiate your product. Have a USP. For example, you could promote your alkaline water for better hydration, or water packaged in an environmentally conscious glass bottle. Healthy and premium attributes (mineral-enriched water or water sourced from the Himalayas) may justify premium pricing. Have a sharp and attractive label. For local markets, portray the tagline of “freshly bottled from [your region] – assured safety” on the label.

Distribution and sale strategy is important. Prioritize based on the earlier stage at hotels, hospitals, gyms, offices, and events where bulk orders are common. Use your local network of wholesale buyers and retailers; also mark your name on online marketplaces for wider visibility. Bring in social media attention with videos of your mineral water plant tour, hygiene practices, or customer testimonials. A great online presence and great SEO will reach the growing number of consumers searching for 'best water near me' or 'pure mineral water'.

Finally, consider tie-ups or small promotions; for instance, tying up with the local health clinic or gym helps spread the word. Sampling at community events goes far in giving people a chance to taste and develop confidence in their water. The key is brand trust and visibility. Quality endorsements, along with strong, consistent branding, turn customers into repeat buyers.

In 2025, the packaged water sector has far from been considered saturated. High and growing demand, as the data say, reflects the potential to make mineral water plant highly profitable. Sure, investment comes first, and cracking new regulations is the other, but a focus-driven entrepreneur would reap the rewards from both. The market's CAGR and size thus project drinking water as still a major commodity in India. With the right place, some nose for quality, and a splash of marketing, you can build a vibrant niche.

Ready to dive in? Aim Technologies, a leading mineral water plant manufacturer, provides full support for newbies. From plant designing and machinery to installation and ensuring compliance, Aim Technologies is here to help you commence on the right track and do so fast. Contact Aim and turn bottled water boom in India into your business success.

Ans. Yes, starting a mineral water plant in 2025 is still highly profitable. With rising demand for clean drinking water, growing health awareness, and gaps in public water supply, the water bottle business continues to thrive, especially in urban and semi-urban India.

Ans. You’ll need an FSSAI license, pollution control clearance, company registration, and regular water quality testing reports. BIS/ISI certification is now optional but still recommended for brand credibility.

Ans. Profit margins typically range from 10% to 30%, depending on your target market, brand value, and operational costs. Premium products like alkaline or flavored water can offer even higher margins.

Ans. Turnkey solution providers like Aim Technologies offer complete assistance, from plant design and equipment to regulatory guidance and installation.

Subscribe To Our Newsletter to get the latest news, updated and amazing offers delivered directly in your inbox.